When it comes to choosing retirement advisor, ARF investment risk management needs just as much attention as securing competitive charges. Highly strategic ARF portfolio construction and monitoring is essential, and a robust solution, requires much more nuance than a simple reliance on ESMA risk scales.

When shopping around most ARF investors think mainly about charges, but when it comes to bottom line performance, a deeper understanding of ESMA and risk buckets is all important. I agree, and would emphasize that the charging structure is pillar one, but a reliance on one or two ESMA risk rated funds, with annual reviews, simply doesn’t cut the mustard in the ARF space.

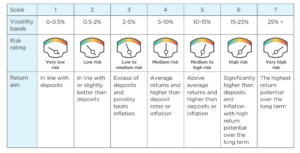

The majority of risk-rated funds/portfolios are built around the ESMA scale, which was developed by EU regulators (European Securities and Markets Authority) for UCITS funds. This scale (from 1 to 7) is based on the volatility of a fund’s returns over the past five years. Greater volatility implies a higher risk level (loss potential), but also better return potential. Here’s a chart of the ESMA scale:

Paying attention to the volatility bands, a fund with a ‘4’ rating (medium risk) could expect to experience a fall of between 5% to 10% in a down market.

What I’m getting at here, is that ESMA and similar risk ratings methodologies, should act as a guide, but ARF portfolio construction should then go deeper than simply sitting in a risk bucket (EMSA Scale) until your next annual review.

ARF investors will typically have had past experience investing in funds, and will have formed an opinion of various insured providers, but you should understand that the volatility range is “expected”; “actual” range can be different (worse) in sudden market falls.

Indeed, anyone who has invested in funds in the past through regular savings, a lump sum investment, or a private pension plan, is likely to have undergone a risk profiling exercise to identify their tolerance, which was then matched to the time horizon of that investment type, but ARF investing is different.

How ARF Investing is Different

ARF investing is different, primarily due to the fact that regular withdrawals will always occur from age 61 onwards. This adds what’s technically called “sequence risk” meaning that time horizon does not offer same safety buffer, from a market recovery perspective. It does not allow the same amount of money to recover from any downside event, as withdrawals constantly challenge returns. So, particularly where ARF funds lean into the medium risk space, additional risk hedging is essential.

Perhaps ESMA is a reasonable, practical and easily understood method to reflect an investor’s risk/reward profile. However, we believe that ARF investors, need an additional line of defense with a more nuanced approach to risk management.

When working with One Quote Financial Brokers, this means hedging against downside risk and making sure that your ARF portfolio remains correctly aligned, with fund preservation and targeted returns in mind.

The bottom line here is that, as you shop the market for fair, competitive and transparent charges, really look to understand what you’re paying for and how well your source of retirement income is protected from downside risk. Be confident in the monitoring and review strategy, which should lead to a long-term supportive professional relationship.

We have designed ARF process, based on a personalised and strategic risk-managed approach, so please contact us to learn more.

Free ARF Consultation

To arrange a free initial 30 minute consultation by phone, or video call, please contact us today. Contact: Ken O’Gorman – Director – CB, QFA, RPA, SIA – One Quote Financial Brokers on: 01 845 0049 or email: ken@onequote.ie

Or enquire online and give us a quick outline of how we can help.